Vietnam boasts high digitalization in production, as can be seen in their digital textile industry – a woman checks garments in a computerized embroidery machine in Ba Ra. (IMG/Dong Nhat Huy / Shutterstock)

Asia Pacific’s golden age in cross border e-Commerce has begun: Here are the opportunities

The Asia Pacific. Home to nearly 4.7 billion people, or 60% of the world’s total population, this region has been earmarked for intensive growth in the digital economy in the near future.

In fact, just Southeast Asia alone is predicted to reach a US$1 trillion digital economy by 2030, according to Google, Temasek, and Bain.

It might even overtake the West’s digital economy, and this is quickly showing potential with just how cross-border trade is flourishing in the region.

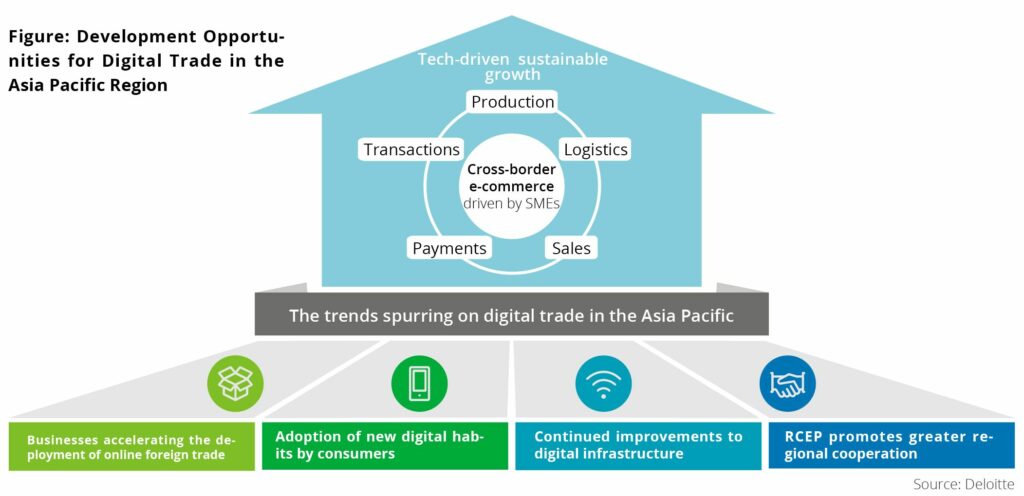

According to a new report by Deloitte published yesterday, the ‘Technology-empowered Digital Trade in Asia Pacific’, the firm predicts that digital trade will further accelerate, and leapfrog the region into the golden age of digital trade in the next three years.

The report accounts for this dramatic shift through increased dynamic cross-border e-Commerce activities, strengthened regional cooperation through the RCEP, increased digitalized lifestyles, and ongoing development of digital infrastructures.

According to Taylor Lam, Vice-Chair and Technology, Media & Telecommunications Industry Leader at Deloitte China, the combination of the Covid-19 pandemic together with these other factors will see new development opportunities in digital trade.

“Digital technologies enable global sellers to participate in global trade without any entry barriers,” said Gary Wu, Deloitte Global Lead Client Service Partner.”

Wu also added that the continuous improvement of digital infrastructure will effectively resolve the two major constraints affecting cross-border trade: logistics and payments, with blockchain technology also “creating a new space of imagination for digital trade.”

Digitalization, mMNEs will drive cross border trade

The report highlighted some key insights for the Asia Pacific, with the first revolving around key technologies and the important role they play.

According to Deloitte, data factors will feature prominently alongside how other critical infrastructure such as 5G, which will help build data distribution platforms and new network architectures and facilitate the Internet of Everything (IoE). Unsurprisingly, AI will continue working alongside big data to bring deeper insights for better decision making.

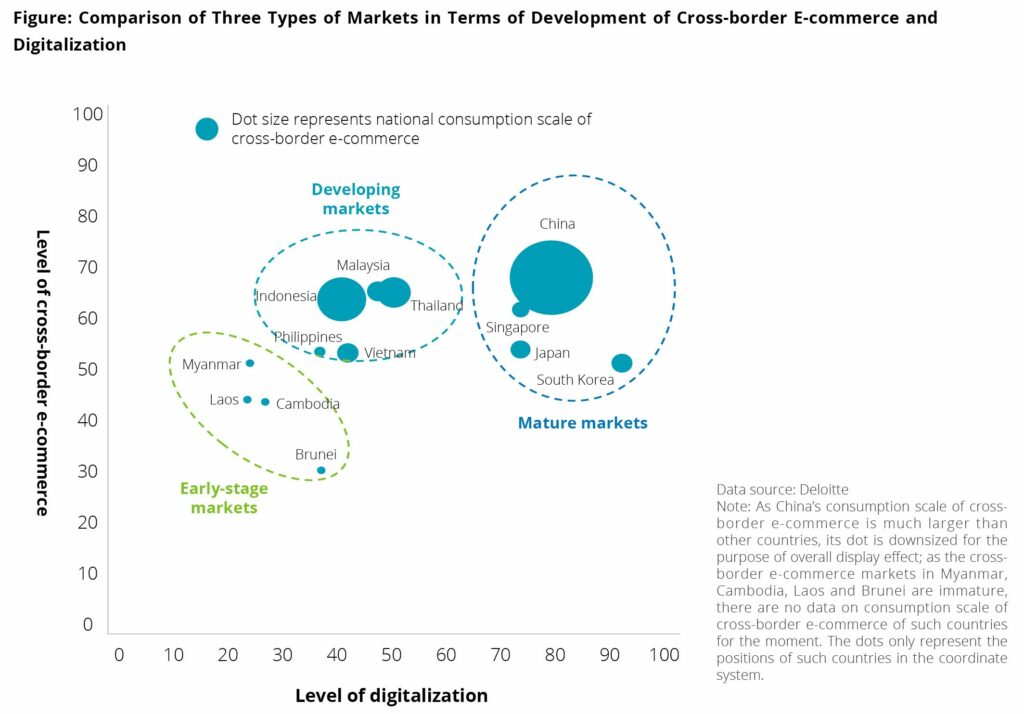

Secondly, the report identified and analyzed various APAC markets for the development and maturity of digital trade across two dimensions: cross-border e-Commerce (60%) and digitalization (40%).

Deloitte classifies the markets as follows:

- Mature markets: China, South Korea, Singapore, and Japan;

- Developing markets: Thailand, Malaysia, Indonesia, Vietnam, and the Philippines;

- Early-stage markets: Myanmar, Cambodia, Laos, and Brunei.

Comparison of the three market types in terms of development (IMG/Deloitte)

Thirdly, there is a substantial rise of micro-multinational enterprises (mMNEs) in the region, which has been identified as the main driver of the transformation of digital trade across the Asia Pacific.

With the help of digital platforms, entrepreneurs and small businesses have become mMNEs as they are engaged in cross-border e-commerce across global markets.

mMNEs provide diversified “locally-made products” and light customization services for global buyers while contributing to over 85% of Asia Pacific’s cross-border e-commerce activities.

Here are the main characteristics of an mMNE:

- More adept at leveraging digital platforms

- Small in scale, typically with fewer than 100 employees

- Globalized operations with an average of 3.56 overseas outlets

Regional cross border business opportunities

Invariably, the degree of digitalization differs across markets, depending on their maturity stage. As digitalization is a yardstick by which market maturity can be measured, it is crucial to track the development of digitalization across developing and early-stage markets.

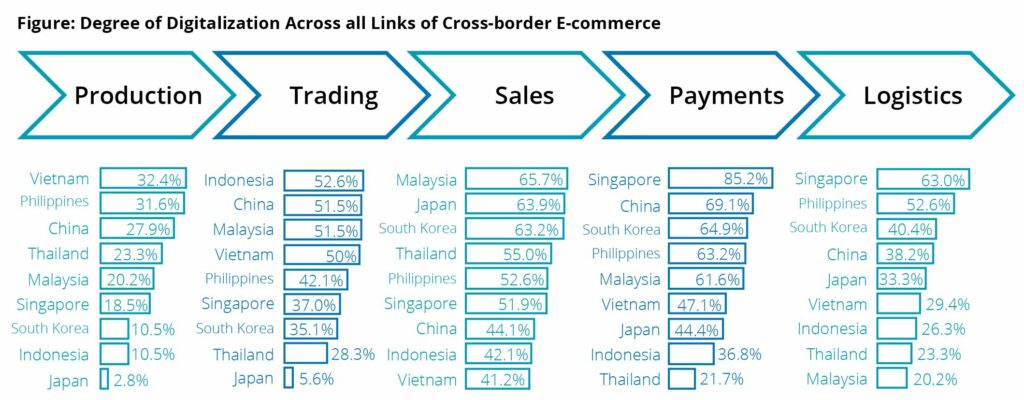

Matured markets generally fared better in terms of sales, payments, and logistics, whereas developing markets tended to lead in production and trading.

Understandably, early-stage markets are still in their nascent stages of digitalization across all facets of cross-border e-Commerce.

Vietnam, as expected, leads digitalization in terms of production, whereas Indonesia leads in trading. Singapore, a mature market, leads in digital payments as well as logistics digitalization.

However, this isn’t always linear.

Degree of digitalization in cross border e-Commerce verticals (IMG/Deloitte)

Interestingly, the report found that Malaysia, classified as a developing market, leads the APAC region in e-Commerce market size at US$6.3 billion. This is a whopping 61.4% of the total e-Commerce market size in China.

The Southeast Asian nation of 32 million also has the highest penetration rate for sales digitalization for cross-border e-Commerce, at 65.7%. However, Malaysia suffers from bottlenecks such as logistics and production (20.2%).

At present, cross-border consumption only accounts for 42% of the market size of the internet economy in Malaysia, which is much lower than mature markets.

Although Indonesia leads digitalization in trading, they are still lagging far behind in production, sales, payments, and logistics. Indonesia has been pointed out by experts to lead the Southeast Asian region in terms of the digital economy.

Vietnam seems to be steadily rising and doing decently in digitalization across most other facets of e-Commerce, whilst also leading digitalization in production.

For these developing markets to move towards maturity, these areas, especially logistics, would need to see more work in terms of development and sophistication.

But at the same time, this presents huge opportunities for private players to come in and develop these industries in these countries.

The state of e-Commerce: Opportunities and analyses

Deloitte expects that the e-Commerce consumer market in APAC will continue increasing in line with continuous digitalization penetration. Here are other key takeaways:

- Singapore: Within Asia Pacific, Singapore continues to act as a central hub for many cross-border e-commerce platforms in Southeast Asia, with companies such as Shopee, Lazada, Amazon, and Zalora setting up their headquarters there. The e-commerce market in Singapore is predicted to double in size in 2025 compared with 2020, with gross merchandise volume (GMV) amounting to US$8 billion.

- Indonesia: Demographic dividend, internet penetration rate, and consumer habits create great potential for developing e-commerce and cross-border e-commerce in Indonesia. Social e-commerce is thriving, and consumers are fond of trading on social media. Indonesian consumers like buying in-expensive products, and the average transaction is low at US$36, much lower than Malaysia (US$54) and Singapore (US$91). Users also prefer e-commerce platforms in their local language, which greatly affects their shopping experience.

- The Philippines: E-commerce has huge growth potential but is constrained by a low internet penetration rate and an undeveloped e-payment industry – the penetration rate of e-commerce users only accounts for 39% of the total population.

- Thailand: The penetration rate of cross-border e-commerce in Thailand is relatively high and has a certain digitalization foundation, but their degree of development is limited. However, quality improvements of internet infrastructure will raise the efficiency of information exchanges and unleash the vitality of e-commerce platforms.

- Vietnam: Although high logistics costs are almost the biggest challenge in cross-border e-commerce in the APAC, 61.8% of the surveyed enterprises in Vietnam believe that the largest challenge is the difficulty in customs clearance inspections, with more than 60% of businesses focusing on green development goals.

- Brunei: Brunei takes the lead in internet penetration rate in Asia even though early-stage markets have a relatively low overall level of digitalization, and generally have no sophisticated infrastructure and platforms in place to develop the digital industry.

READ MORE

- Micron Technology invests RM1 Million for semiconductor research at Malaysian universities

- Shein, Shopee and Meesho overtake Amazon in 2021

- Data security is an expectation for APAC consumers

- Malware exploits Microsoft’s e-Signature verification

- What’s spooking Tencent and making them sell their shares off?